For upgrade of membership plan the top-up fee will differ according to the expiry date of your existing membership plan. Dividend for 2020-21 Rs.

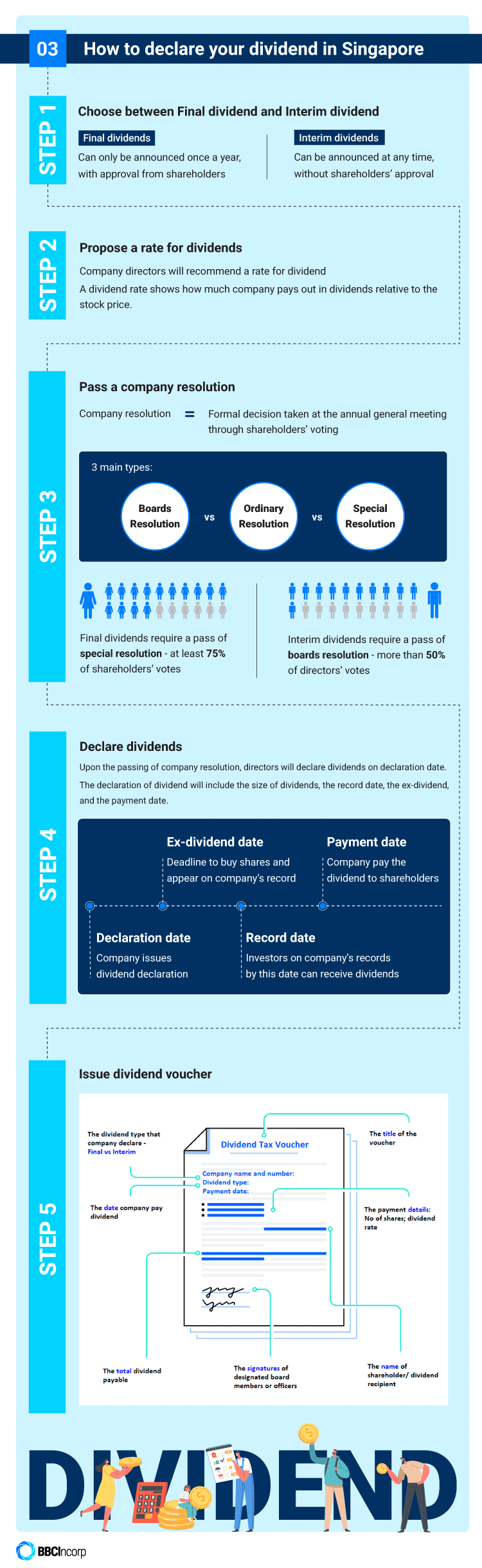

Dividend Declaration Rules In Singapore

Kelington told Bursa Malaysia on Monday Aug 15 that the ultra-high purity UHP division remained as the primary revenue contributor contributing to 63 of the groups total revenue in 1HFY22.

. Further USA Company paying the dividend also has a right to tax the said dividend in their state. Tax depreciation thin capitalisation provisions tax loss carry forwards prescribed in the Act on Corporate Tax and Dividend Tax CDTA. KUALA LUMPUR Aug 30.

Income from any Indian source property or asset. Compared with the previous years. Most dividend income earned from Korean sources is subject to 154 tax withholding at source.

Currently the miner is planning to invest A500 million to expand capacity at its Western Australia-based Mt Weld mine in an attempt to meet the demand for. Income from any business connection in India. There are over 200 GOCCs as of 2020.

Foreign resident taxpayers who have stayed in Korea for longer than five years during the last ten year period are required to include any dividends received from non-Korean sources in global income and to pay taxes thereon at the greater of basic. However if the beneficial shareholder is a resident of India ie. Transfers of shares in an unlisted Malaysian company attract stamp duty at the rate of 03 percent of the value of shares.

In the Philippines a government-owned and controlled corporation GOCC sometimes with an andor is a state-owned enterprise that conducts both commercial and non-commercial activity. Generally a company is allowed to pay pre-sale dividends. I hereby authorize HDFC Ltd.

Dividend payments are discussed later in this report. Any final dividend for a financial year will be subject to Shareholders approval. I hereby authorize HDFC Ltd.

To capture the full impact of the share consolidation which followed the sale of our businesses in Thailand and Malaysia as if it took place at the start of the 202021 financial year. I declare that the information I have provided is accurate complete to the best of my knowledge. Maybank Malaysia Ethical Dividend Fund.

And its affiliates to call. A shareholder is any person company or other institution that owns at least one share of a companys stock. Capital gains on transfer of an Indian capital asset.

The company did not declare a dividend. I declare that when investing in any unit trust funds or wholesale funds or other products offered by Maybank AM I am aware of the investment risks of that. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more.

Prospectus IM PHS Product Brochure. Form EA Annual income statement prepared by company to employees for tax submission purpose Deadline. The main intention of the introduction of this tax is to encourage companies to declare a dividend to the shareholders.

Payment of dividend by an Indian Company whether inside or outside India. The group proposed to declare a one-sen dividend amounting to RM643 million to be payable on Sept 22. Because shareholders are a companys owners they reap the benefits of.

The dividend under the Dividend Policy proposed andor declared by the Board for a financial year are deemed as final dividend. CP 58 Commission fees statement prepared by company to agents dealers distributors. A resident of the other contracting state then the.

I declare that the information I have provided is accurate complete to the best of my knowledge. 30 per equity share of 2 each. 23 per equity share of 2 each.

The Company has always attached great importance to shareholder returns. Dividend per share. If in connection with the announcement of a dividend by the Company on B shares the Board of Shell Transport andor the Board of BG elected to declare and pay a dividend on their respective dividend access shares to the Trustee the holders of B shares were beneficially entitled to receive their share of those dividends pursuant to the.

And its affiliates to call email send a text through the Short messaging Service SMS andor Whatsapp me in relation to any of their products. Kalkine Media provides Stock Market News ASX News Financial News Australian Stocks Research Analysis Latest coverage on all ASX Listed Companies for all sectors. The Company continued to make breakthroughs in technological innovation.

Dividend for 2021-22 Rs. Maxis operating free cash flow rose by a substantial 403 per cent year-on-year to land at RM117 billion on the back of the groups solid capital management initiatives enabling it to declare an interim dividend of 5 sen net per share for the quarter. The taxable base is calculated by adjusting the accounting pre-tax profit shown in the taxpayers financial statements by the tax base increasing and decreasing items eg.

The consent herein shall override any registration for DNCNDNC. Examples of the latter would be the Government Service Insurance System GSIS a social security system for government employees. Indian Central or State Government paid royalty interest or any fee under specific situations.

Maybank Malaysia Dividend Fund. Malaysia does not impose withholding tax WHT on dividend payments. NCT Alliance Bhds net profit for the second quarter ended June 30 2022 2QFY22 rose 17 to RM111 million from RM948 million a year earlier mainly contributed by its ongoing Grand Ion Majestic GIM projectRevenue for the quarter dipped to RM4882 million from RM4923 million previouslyEarnings per share slipped to 126 sen.

The Board of Directors has decided to declare an interim dividend of HK070 per share tax inclusive which hits a record high. The Company may declare and pay dividends by way of cash or by other means that the Board considers appropriate. Maybank Malaysia Growth Fund.

As such Adjusted diluted EPS adjusted for share consolidation is presented on a basis other than in accordance with.

Guide To Declaring Dividend In Company

Ex Dividend Date What It Is How It Works Seeking Alpha

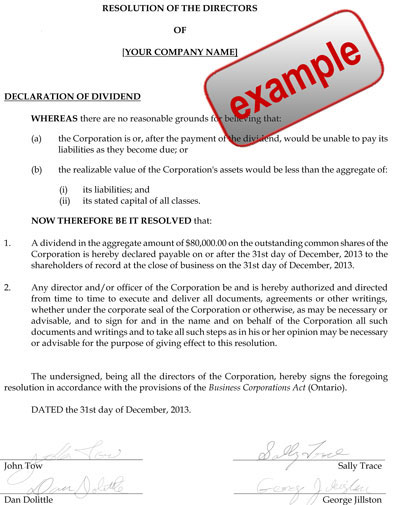

Declaring A Dividend On Shares Of A Company Resources For Canadian Business Owners

Important Dividend Dates Overview Key Dates Examples

Dividend Declaration Rules In Singapore

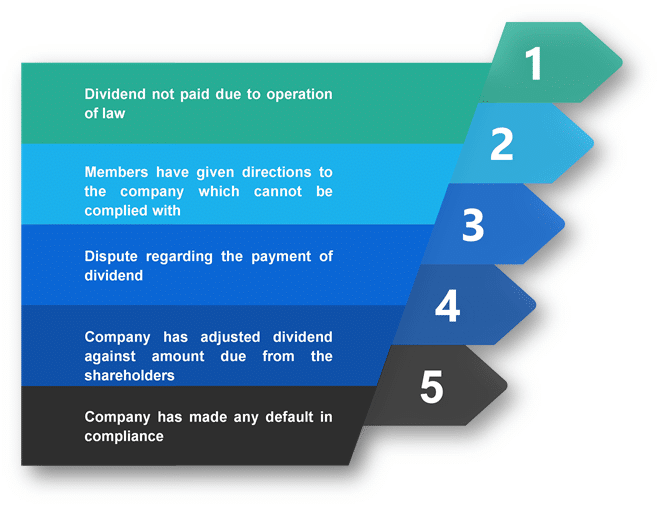

Declare And Pay Dividend In Case Of Loss Or Inadequate Profits

Declaration And Payment Of Dividend Under Companies Act 2013

Declaration Of Interim Dividend By Private Limited Company Indiafilings

Dividend Declaration Rules In Singapore

Dividends Declared Journal Entry Double Entry Bookkeeping

Declaration And Payment Of Dividend Under Companies Act 2013

Dividend Declaration Rules In Singapore

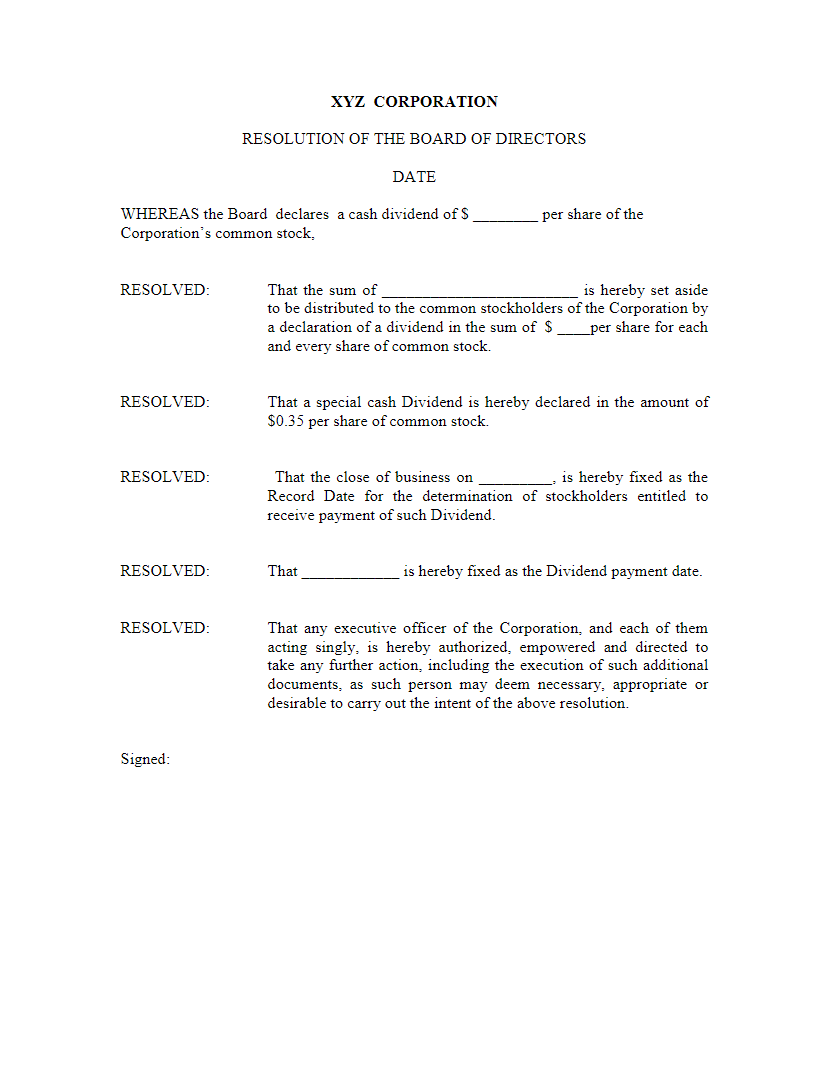

Format Of Board Resolution For Recommendation Of Dividend

Declaration And Payment Of Dividend Under Companies Act Enterslice

Procedure For Declaration Of Dividend Lawrbit

Procedure For Declaration Of Dividend Out Of Reserves Ipleaders

Leading Malaysia Estate Planner Can Bring The Best Solutions For You Will And Testament Notary Service Living Trust

Indigo To Start 6 New Flights Connecting Kolkata From July 20 Indigo Airlines Indigo Best Airlines To Fly

Procedure For Declaration And Payment Of Interim Dividend By The Board Of Directors